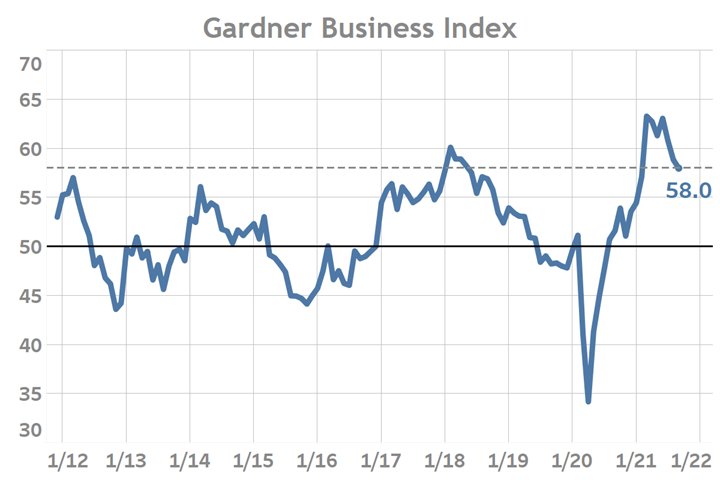

Gardner Business Index shows slow expansion in third quarter

The Gardner Business Index (GBI) closed September at 58.0. Employment, production, new orders and backlog activity all registered slowing expansion during September.

The Gardner Business Index (GBI) closed September at 58.0, marking the third consecutive month in which the overall Index registered slowing expansion. Five of the six measures which constitute the GBI moved lower in absolute terms led by a quickening contraction in export orders. Employment, production, new orders and backlog activity all registered slowing expansion during September. The latest reading for supplier deliveries—which assesses the performance of supply chains—moved higher, indicating that a rising proportion of surveyed manufacturers experienced worsening supply chain performance. Removing the influence of disrupted supply chain activity from the GBI would have resulted in a September reading of 53.1 and the lowest year-to-date reading thus far. Although the latest data are raising concern, it is important to remember that it is normal for growth to slow when supply and demand seek a new equilibrium. In past business cycles there have been several instances in which business activity readings fell towards a level of ‘50’ (representing no change from month-to-month) before again reporting future months of accelerated expansion.

The Gardner Business Index reported slowing expansion throughout the third quarter of 2021 as slowing payrolls and the on-going disruption in supply chains weighed on production activity.

In seven of the last nine months through September, production readings have fallen below same-month new orders readings, resulting in a “production deficit” manifested by heightened backlog readings. The initial cause of this production deficit was underperforming supply chains, resulting in a lack of production materials. However, during the third quarter production activity was further constrained by limited labor availability. September’s employment reading marked the slowest expansion in manufacturing payrolls since rebounding from COVID-19’s initial shock in mid-2020. The latest reading marked the third consecutive month of slowing employment activity. The latest reading indicated that only a small majority of manufacturers are either maintaining or expanding payrolls.

RELATED CONTENT

-

The Future of Valve Manufacturing is Already Here

Companies in the valve and control products industry are responding to a confluence of forces that are changing the landscape of manufacturing — automation, agility and digitalization to name a few.

-

PFAS Chemicals and PTFE: Should the Valve Industry Be Concerned?

Legislation moving through Congress could affect the future use of thousands of PFAS chemicals (per- and polyfluoroalkyl). The house passed H.R. 2467 in July of 2021 and, though the bill is general in nature, it assigns the responsibility to the Environmental Protection Agency (EPA) for determining which PFAS chemicals will be controlled or banned altogether.

-

Ancient Roman Valves

The story of water supply in the ancient Roman Empire is grand.

.jpg;width=70;height=70;mode=crop)

Unloading large gate valve.jpg;maxWidth=214)